It has been three years since the emergence of COVID-19 and its impact on global life. To understand how the pandemic affected public media’s financial health, we analyzed station Annual Financial Report (AFR) data from the Corporation for Public Broadcasting (CPB) to help uncover recent trends in public radio and television finances.

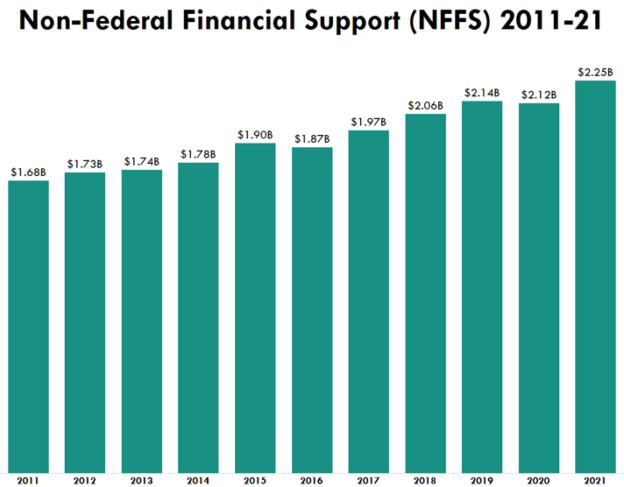

Our analysis has found that overall public media revenue in 2021 (the latest available year of AFR data) was higher than ever before. Non-Federal Financial Support (NFFS), which includes fundraising revenues and support from states and universities, topped $2.25 billion in 2021 and has grown by 34% since 2011. But revenue trends have varied by organization. Public television stations have performed better than radio during the pandemic (mostly because of radio underwriting declines) and, continuing a long-term trend, large stations have outgrown small stations.

We also analyzed stations’ total revenues, a larger dataset than NFFS that includes funding from CPB and other sources. Revenues in 2021 exceeded $4.1 billion, a 29% increase from 2020. However, this growth is likely to be shortlived as 2021 numbers were boosted by federal pandemic relief funds as well as significant stock market gains for station endowments. As every market watcher knows, stock values eroded last year. Endowment gains from 2021 very likely eroded too — and we won’t know by how much until financial reports from fiscal 2022 are available later this year.

Financial analyses of public media stations typically focus on NFFS rather than total revenues. That’s because NFFS tracks the revenue sources that are within the control of stations, including individual giving, sponsorship, and institutional support.

When we took a deeper look at financial trends for different stations and categories, here are the significant findings we saw:

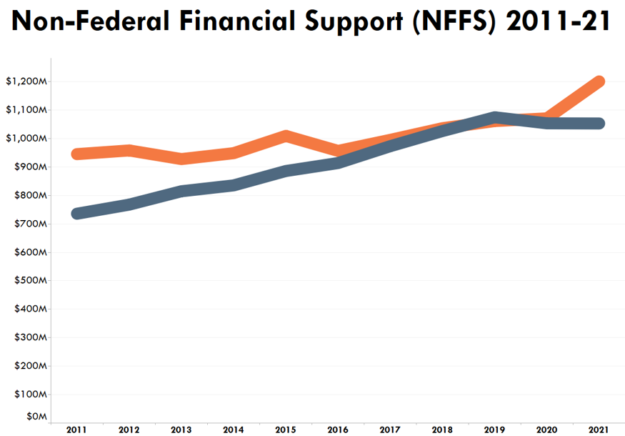

Reversing a long-term trend, public television outgrew public radio in 2020 and 2021. In fact, radio NFFS declined slightly in both years. It’s the first time in recent history that public radio has experienced a year-over-year decrease in NFFS.

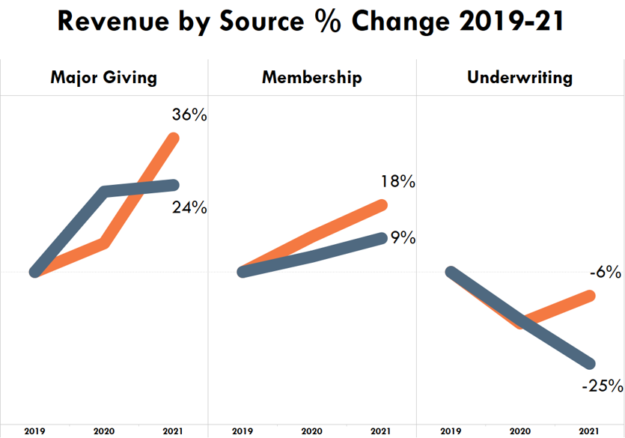

Much of radio’s decline was driven by a significant downturn in sponsorship revenue (down 25% between 2019 and 2021). Commercial media experienced a similar decline but public television somewhat bucked the trend and grew its underwriting revenue from 2020 to 2021.

Public television also outgrew radio in individual giving. TV major giving revenue grew by 36% between 2019 and 2021 (compared with radio’s more modest 24% growth) and TV membership revenue grew by 18% (compared with 9% for radio). Passport subscriptions helped boost television membership revenue numbers thanks to the widespread adoption of streaming during the early part of the pandemic.

The pandemic changed many things but the previous trend of small public media stations not keeping pace with their larger counterparts continued. From 2019 to 2021, the largest third of public media stations grew their NFFS by 9% whereas the smallest third saw an NFFS drop of 3% (the 10-year trend is starker: 46% growth in NFFS for the largest stations and a 13% decline for the smallest).

One of the key reasons for this trend is an ongoing decline in institutional support for small stations. Direct and indirect assistance from universities, states, and school districts is a large and critical component of small station revenue and it’s being hit hard. Institutional support for small stations has declined 28% since 2013 and this compares with a 12% increase for large stations.

It is because of disproportionate cuts in institutional support and other challenges faced by small stations that Public Media Company launched the Impact for All initiative in 2021.

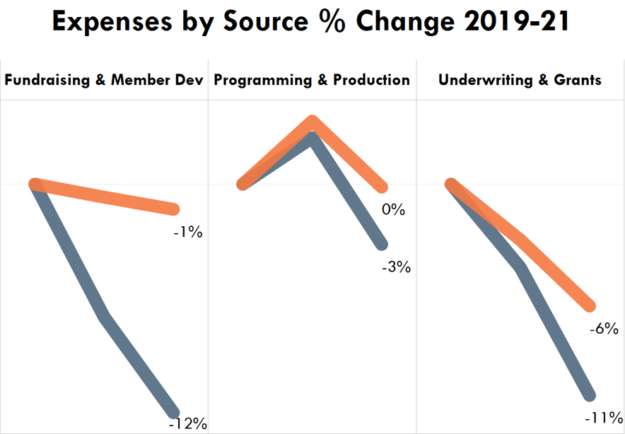

Budget cuts can have long lasting effects on future financial performance. During the Great Recession, public television stations made significant cuts in their fundraising and content budgets. These may have contributed to public television’s struggle to recover financially during the post-recession period. Public radio stations didn’t make the same budget cuts. In 2021, public TV stations spent less on content and fundraising than they did in 2008. Despite recent growth in public TV revenues, NFFS for television as a whole is less today than it was in 2008.

Public radio stations didn’t cut their spending on content and fundraising during the recession and their revenues continued to grow annually, until COVID.

During the pandemic, radio has made the most significant expense reductions. Between 2019 and 2021, public radio stations cut costs in fundraising by 12%, content by 3%, and underwriting/grants by 11%. Hopefully, this will not lead to a repeat of TV’s Great Recession experience.

Please remember that the data in this post is for all public radio and television stations combined that report AFR to CPB. An individual station’s experience may not be consistent with overall trends. The charts and percentages in this post reflect overall industry totals and should not be assumed to be the trends of each individual public media station.

If you have questions about the data in this post or have other data questions on your mind, please contact Steve Holmes at steve@publicmedia.co.