Local public media organizations demonstrated a remarkable resilience in recovering from the negative financial impacts of the early years of the COVID-19 pandemic, according to our analysis of recently released data from the Corporation for Public Broadcasting (CPB). Looking at Annual Financial Report (AFR) data for all public radio and TV stations that have consistently reported their numbers to CPB over the past decade, an encouraging rebound and some interesting trends emerge.

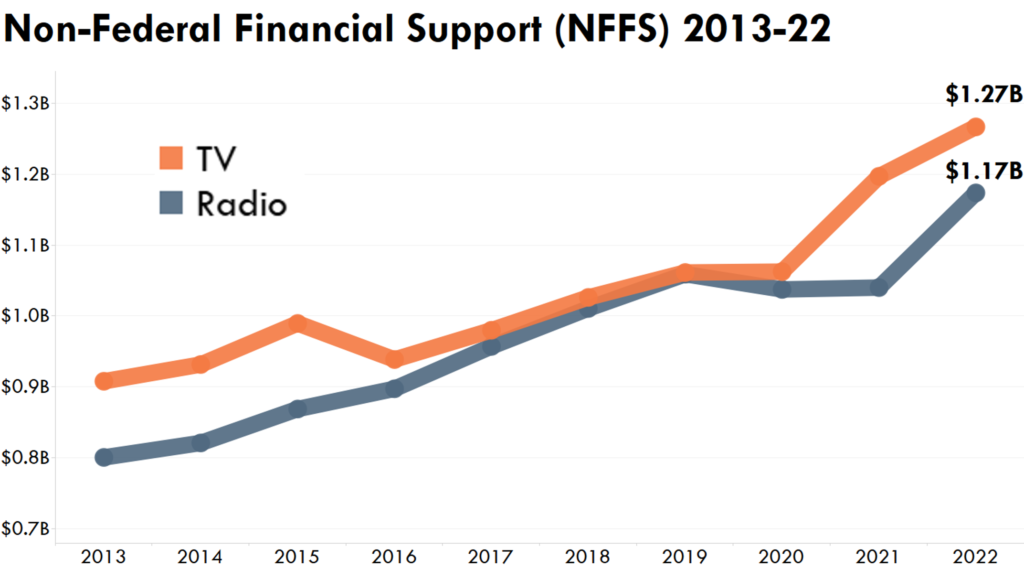

Overall, non-federal financial support has rebounded well since hitting a low in 2020 and, based on the most recent AFR data, was at its highest ever level in 2022 – approaching $2.5 billion across the entire local public media system and up by 43% since 2013 (significantly above the Consumer Price Index over the same period). Both radio and television grew significantly from 2020 to 2022, with radio rebounding in 2022 after revenue declines in 2020 and 2021. Encouragingly, financial gains were seen across small, medium, and large stations in 2022.

Small stations are defined as those in the smallest third of all public media organizations (non-federal financial support below approximately $1M a year for radio stations and below $2.2M for TV stations). Large stations are the largest third of stations in the system (non-federal financial support above approximately $2.5M a year for radio stations and above $7M for TV stations).

Revenue gains driven by a variety of sources.

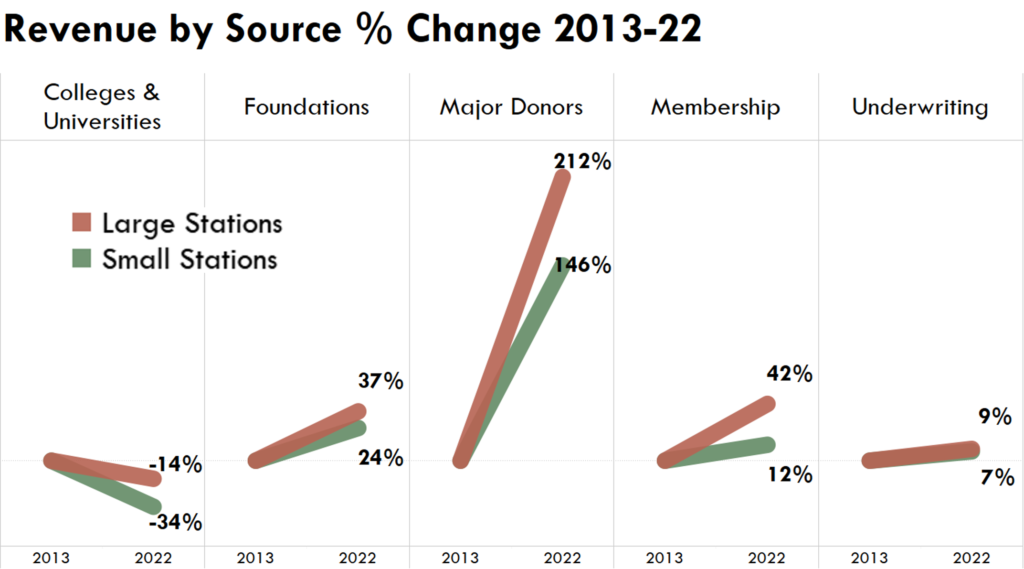

The post-pandemic revenue growth was largely driven by increases in support from major donors (up 47% since 2020). This was especially true for TV stations which saw a major donor revenue boost of 80% between 2020 and 2022. Underwriting also rose in 2022, particularly for radio stations which generated $50 million in new underwriting revenue in 2022 after year-over-year declines in 2020 and 2021. Additionally, radio attracted more foundation support, possibly an early indication of growing interest in funding local news. State funding for TV also saw a boost.

However, not all revenue sources grew. Federal funding dropped considerably without pandemic relief dollars – by $86 million for TV and $64 million for radio. Still, non-federal revenue outpaced the federal declines. University support also failed to rebound in 2022 and was much lower than a decade ago (down 18% since 2013 before even adjusting for inflation), likely signaling ongoing funding issues at educational institutions and potential implications for the more than 40% of public media stations that are licensed to a university.

But what about 2023? It takes considerable time for public media organizations and CPB to collect, organize, process, submit, and review financial data from every eligible station across the country, and this inevitably means that AFR data is not a leading indicator of current financial performance. For more up to date insight on individual giving trends at public media organizations, check out the Contributor Development Partnership (CDP) articles in Current where the CDP team provide monthly updates on recent trends from their Public Media Index of 171 TV, Radio and Joint licensee stations. We are also interested in learning more about your experience, and if the trends of 2022 still hold true in early 2024. If you’d like to share your experience, please reach out to us.

Small stations unable to keep up.

While smaller stations did grow in 2022, the rate trailed behind larger stations, further widening the gap between the growth rates of public media organizations serving smaller communities and their larger market peers. Between 2013 and 2022, large public media organizations outpaced small organizations across every revenue source, including in university and foundation support. This may indicate that smaller public media organizations have less influence and capacity to make their case to funders in their communities and beyond.

Public media investing more in its future.

Expenses also grew in 2022 after cuts in key areas in 2020 and 2021. To build future capacity and impact in the community, radio and TV stations invested significantly more in fundraising and content in 2022 compared with earlier pandemic years. An additional $100 million was spent on programming and production in 2022 (up to an all-time high of $1.53 billion) and fundraising and underwriting received a combined boost of nearly $40 million.

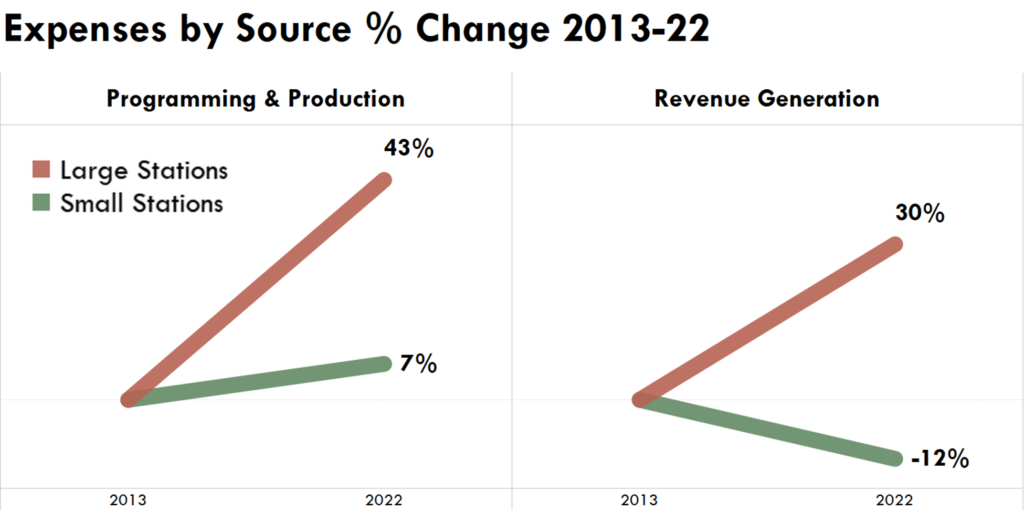

Small and large orgs investing at different rates.

While it is very encouraging that the public media system was able grow its investment in critical areas in 2022, stark historical differences persist between small and large organizations. In 2022, large stations invested 43% more in content and 30% more in revenue generation than they did in 2013. For small stations, content investment growth was just 7% and revenue generation expenses were down 12%. These ongoing investment difficulties may help explain why stations serving smaller communities weren’t able to keep pace with the revenue gains of their larger counterparts over the past decade.

Local public media is resilient.

Though the pandemic dealt an undoubted shock, the AFR data suggests that public media was generally in good financial health at the end of 2022, recovering well from the negative impacts of COVID-19 in 2020 and 2021. Challenges remain, particularly for smaller stations, but local public media organizations have shown great resilience and an ability to emerge from disruption on a steady financial footing and in a position to further grow their local impact.

Please remember that the data in this post is for all public radio and television stations combined that have consistently reported AFR to CPB over the past decade. An individual station’s experience may not be consistent with overall trends. The charts and percentages in this post reflect overall industry totals and should not be assumed to be the trends of each individual public organization.

If you have questions about the data in this post or have other data questions on your mind, please contact Steve Holmes at steve@publicmedia.co.